Gujarat International Financial Tec-City (GIFT City) is India’s first International Financial Services Centre (IFSC), established under the Special Economic Zones Act, 2005 and the International Financial Services Centres Authority Act, 2019. It is a dedicated financial jurisdiction offering a wide range of financial services to both resident and non-resident entities in foreign currencies.

It’s a hub for financial and IT companies from around the world, offering an ideal ecosystem for both local and international businesses. The IFSC at GIFT City enables onshore and offshore financial services and its mission is to offer cross-border financial products and services within a competitive tax environment.

Under the current Foreign Exchange Management (International Financial Services Centre) Regulations, 2015, any financial institution or branch of a financial institution set up in the IFSC and permitted/recognized as such by the Government of India or a Regulatory Authority is treated as a person resident outside India (PROI). The International Financial Services Centres Authority (IFSCA) is a unified authority for the development and regulation of financial products, financial services and financial institutions in the IFSC in India.

3PIM International (IFSC) LLP is registered with the International Financial Services Centres Authority (IFSCA) as a Registered Fund Management Entity (Non - Retail) bearing registration number: IFSCA/FME/II/2024-25/140.

3PIM International (IFSC) LLP has a non-binding advisory agreement with 3P Investment Managers Private Limited for research & investment related support and it also has a service level agreement for operational & other support function.

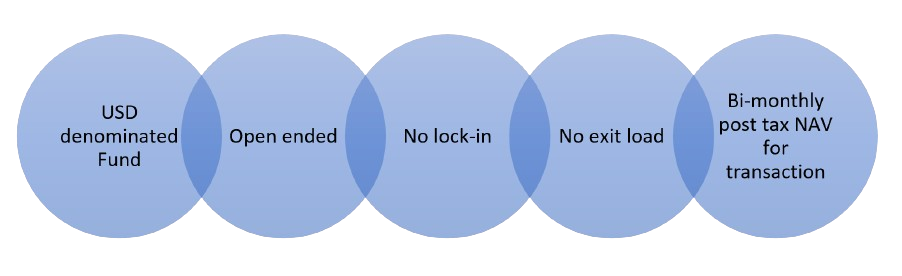

Category: Category III AIF

Tenure: Open-Ended Scheme

First allotment date: 06 May 2025

Asset Under Management: USD 53.9 million as on 31st August 2025

Our GIFT City Team:

Himanshu Agarwal (Vice President - Investments)

Mohit Jain (Manager - Operations)

Richa Agarwal (Compliance and Risk Officer)

Venu Menon (Principal Officer)

• No requirement of a demat account. No requirement of PAN if the investor does not have any other income from India.

• Taxation at the fund level

Objective: The Fund has been set up with the objective to achieve long term capital appreciation by investing in permissible securities/instruments in accordance with the Fund Documents and the IFSCA FM Regulations.

Investment Philosophy: The investment philosophy at 3PIM International (IFSC) LLP is guided by a simple principle: own strong businesses at reasonable valuations. Owning strong businesses in their respective domains reduces the risk of permanent capital loss and paying reasonable valuations mitigates the risk of poor long-term returns. Further, as the time horizon increases, the risk in equities reduces. We aim to follow a low churn strategy that also lowers costs.

Portfolio characteristics: In line with the Investment Philosophy of 3P, nearly 79% of the Fund (additionally there is 9% in cash) in our judgement comprises of companies that enjoy leadership / strong positions in respective businesses and should be able to increase / maintain their market share. The portfolio is well diversified across key sectors and economic variables. The Fund is overweight Banks, Insurance and Pharmaceuticals; underweight Automobiles, Capital Goods, Consumer and Software & Services. Exposure to Materials and Telecom is close to market weights.

In our opinion, portfolio companies follow good ESG practices. Interestingly, companies in conventional power have plans to rapidly scale up their renewable portfolio.

We believe that, following recent outperformance, Small and Mid Caps (SMIDs) as a category are once again expensive relative to large caps. Therefore, we have adopted a selective approach to investing in SMIDs and the portfolio is tilted towards large caps.

Currently, the Fund is well-diversified due to low dispersion in valuations across sectors. If and when we see meaningful divergences in some pockets, we will look to consolidate the portfolio holdings.

The Fund is also registered as a Category I Foreign Portfolio Investment (FPI) bearing registration number INIGFP036325 under the FPI Regulations.

Registered office: Unit no. 1116, Signature Building, Eleventh Floor, Block 13B Zone – I, GIFT SEZ Gandhinagar – 382355, Gujarat, India

Tel: +91 79 6517 9000

Email ID: 3pgiftservices@3pim.in